If you have kids, saving up for retirement, so that you can lead a financially independent life post-retirement, may not be enough. You need an education fund as well. We’ll tell you why.

If you’re in your late twenties and plan on having a child, or if you already have one, saving up for a retirement corpus that will help you lead a financially independent life cannot be your only financial goal.

With the cost of education spiraling today, pooling a portion of your savings or income into an education fund for your child is essential. We’re going to tell you how to go about it using Mutual Funds.

Thirty years ago, when our parents focused on creating a corpus for our education or marriage, they depended on investment options like Fixed Deposits, Public Provident Fund (PPF) or physical gold to meet these goals. While these are perfectly safe, long-term investment options, the returns on these are as low as 6-7%. So, while the education fund is safe, the money doesn’t multiply.

Let’s set some context here. The batch of 2018 at the Indian Institute of Management, Ahmedabad (IIM A) will pay a whopping Rs. 19.5 lakhs for their two-year course. This is a 400% jump from what the elite B-school charged in 2007. This number will become Rs. 95 lakhs in 2025.

With the cost of education spiraling at more than 20% per year, parents need to explore investment instruments that will yield considerable returns over a span of time and meet their financial goals. Mutual Funds, in this respect, is one of the most viable options to create wealth for the long term.

Equity Mutual Funds are a compelling investment option for two reasons:

1) Capital gains on the sale of equities with a holding period exceeding one year are tax-free

2) The approximate dividend yield on equities is 1-1.5% annually. Opposed to what is commonly believed, you don’t need to be a financial wizard to taste success with Mutual Funds. Mutual Funds are managed by professionals who have the expertise and foresight to invest in the right kind of stocks. Your money also gets evenly distributed across risky and safe stocks and sectors.

Here are some benefits of investing in Mutual Funds:

1. Investments are made by seasoned fund managers on behalf of investors after discussion, research, and analysis.

2. Mutual Fund portfolios are well-diversified. The risk is thus spread over various types of stocks.

3. An education fund needs flexibility, which is possible with Mutual Funds.

4. Despite short-term volatility, long-term Mutual Funds are ideal as they generate the highest returns.

5. The minimum dividend yield on a pure equity Mutual Fund investment is around 10-12%.

To start investing in Mutual Funds, parents can either create a portfolio exclusively for the purpose of funding their children’s education or to invest in specific children’s plans offered by fund houses.Here are the steps to set up and maintain an education fund using Mutual Funds:

1. Open a minor account that can be operated jointly by both parents.

2.Set up SIPs for amounts that can be comfortably borne by the both of you.

3. Review SIP contributions every year and try to step them up every year.

4.Review investment performance and asset allocation at regular intervals (about once a year). If a fund has been under-performing for a year then there’s no reason to panic. Consider terminating the SIP in the fund only if the under-performance continues for 3 years.

5. You can move the funds to a liquid fund a few months prior to pay out

A few things to note: The amount you will have to save every month would depend on how near in the future you would need to use those funds for your child’s education.

If you’re going to need it 8 years from now, you’ll need to save more than what you have to if you are looking at a timeline of 12-15 years. If you don’t know the fund amount that you will need to aim for, start by researching on the kind of courses that you would want your child to pursue based on his interests and the costs involved in it.

When it comes to investing, the sooner you start the better. Remember, a delayed start will not only leave you with an insufficient corpus but will also put at risk your other financial goals. If you start saving for your child’s education well into your 40s, you may fall short of the required amount.

Source:Bankbazaar.com

If you’re in your late twenties and plan on having a child, or if you already have one, saving up for a retirement corpus that will help you lead a financially independent life cannot be your only financial goal.

With the cost of education spiraling today, pooling a portion of your savings or income into an education fund for your child is essential. We’re going to tell you how to go about it using Mutual Funds.

Thirty years ago, when our parents focused on creating a corpus for our education or marriage, they depended on investment options like Fixed Deposits, Public Provident Fund (PPF) or physical gold to meet these goals. While these are perfectly safe, long-term investment options, the returns on these are as low as 6-7%. So, while the education fund is safe, the money doesn’t multiply.

Let’s set some context here. The batch of 2018 at the Indian Institute of Management, Ahmedabad (IIM A) will pay a whopping Rs. 19.5 lakhs for their two-year course. This is a 400% jump from what the elite B-school charged in 2007. This number will become Rs. 95 lakhs in 2025.

With the cost of education spiraling at more than 20% per year, parents need to explore investment instruments that will yield considerable returns over a span of time and meet their financial goals. Mutual Funds, in this respect, is one of the most viable options to create wealth for the long term.

Equity Mutual Funds are a compelling investment option for two reasons:

1) Capital gains on the sale of equities with a holding period exceeding one year are tax-free

2) The approximate dividend yield on equities is 1-1.5% annually. Opposed to what is commonly believed, you don’t need to be a financial wizard to taste success with Mutual Funds. Mutual Funds are managed by professionals who have the expertise and foresight to invest in the right kind of stocks. Your money also gets evenly distributed across risky and safe stocks and sectors.

Here are some benefits of investing in Mutual Funds:

1. Investments are made by seasoned fund managers on behalf of investors after discussion, research, and analysis.

2. Mutual Fund portfolios are well-diversified. The risk is thus spread over various types of stocks.

3. An education fund needs flexibility, which is possible with Mutual Funds.

4. Despite short-term volatility, long-term Mutual Funds are ideal as they generate the highest returns.

5. The minimum dividend yield on a pure equity Mutual Fund investment is around 10-12%.

To start investing in Mutual Funds, parents can either create a portfolio exclusively for the purpose of funding their children’s education or to invest in specific children’s plans offered by fund houses.Here are the steps to set up and maintain an education fund using Mutual Funds:

1. Open a minor account that can be operated jointly by both parents.

2.Set up SIPs for amounts that can be comfortably borne by the both of you.

3. Review SIP contributions every year and try to step them up every year.

4.Review investment performance and asset allocation at regular intervals (about once a year). If a fund has been under-performing for a year then there’s no reason to panic. Consider terminating the SIP in the fund only if the under-performance continues for 3 years.

5. You can move the funds to a liquid fund a few months prior to pay out

A few things to note: The amount you will have to save every month would depend on how near in the future you would need to use those funds for your child’s education.

If you’re going to need it 8 years from now, you’ll need to save more than what you have to if you are looking at a timeline of 12-15 years. If you don’t know the fund amount that you will need to aim for, start by researching on the kind of courses that you would want your child to pursue based on his interests and the costs involved in it.

When it comes to investing, the sooner you start the better. Remember, a delayed start will not only leave you with an insufficient corpus but will also put at risk your other financial goals. If you start saving for your child’s education well into your 40s, you may fall short of the required amount.

Source:Bankbazaar.com

What is the nomination for mutual fund investors?

The nomination is the process of appointing a person to take care of the assets in the event of the investor’s demise. A nominee can be any person — spouse, child, another family member, friend or any other person you trust. Nomination facility is mandatory for new folios/accounts opened by individuals with single holdings. In the case of joint holdings where there are more than one holders, it is not mandatory to have a nominee, but financial planners recommend that new folios should always have a nominee.

What if an investor does not wish to appoint a nominee?

If the investor does not wish to nominate, he must sign and indicate the same by signing on the requisite space.

How does a mutual fund investor make a nomination?

When you invest in a mutual fund, there is a column where you can fill the details of the nominee. Individuals holding accounts either singly or jointly can make a nomination. But non-individuals including society, trust, body corporate, karta of Hindu undivided family (HUF), holder of power of attorney cannot nominate. Nomination for joint holders is permitted, but in the event of the death of any of the holders, the benefits will be transmitted to the surviving holder’s name. Only in the case of death of all holders will the benefits be transmitted to the nominee.

How many nominees can an investor appoint?

An investor has an option to register up to three nominees in a mutual fund folio. The investor can also specify the percentage of the amount that will go to each nominee in case of his death. If the percentage is not specified, each nominee will be eligible for an equal share.

What are the benefits of appointing a nominee for your mutual fund investments?

When a nomination is registered, it facilitates easy transfer of funds to the nominee(s) in the event of the demise of the investor. However, in the absence of nominee, the heirs/claimant will have to produce a number of documents like a will, legal heir certificate, no-objection certificate from other legal heirs, etc to get the units transferred in his/her name.

Is it possible to change a nominee once an investment is made?

Yes, the nominee can be changed/added/subtracted any time as per the investors wish.

Source:economictimes.indiatimes.com/articleshow

The nomination is the process of appointing a person to take care of the assets in the event of the investor’s demise. A nominee can be any person — spouse, child, another family member, friend or any other person you trust. Nomination facility is mandatory for new folios/accounts opened by individuals with single holdings. In the case of joint holdings where there are more than one holders, it is not mandatory to have a nominee, but financial planners recommend that new folios should always have a nominee.

What if an investor does not wish to appoint a nominee?

If the investor does not wish to nominate, he must sign and indicate the same by signing on the requisite space.

How does a mutual fund investor make a nomination?

When you invest in a mutual fund, there is a column where you can fill the details of the nominee. Individuals holding accounts either singly or jointly can make a nomination. But non-individuals including society, trust, body corporate, karta of Hindu undivided family (HUF), holder of power of attorney cannot nominate. Nomination for joint holders is permitted, but in the event of the death of any of the holders, the benefits will be transmitted to the surviving holder’s name. Only in the case of death of all holders will the benefits be transmitted to the nominee.

How many nominees can an investor appoint?

An investor has an option to register up to three nominees in a mutual fund folio. The investor can also specify the percentage of the amount that will go to each nominee in case of his death. If the percentage is not specified, each nominee will be eligible for an equal share.

What are the benefits of appointing a nominee for your mutual fund investments?

When a nomination is registered, it facilitates easy transfer of funds to the nominee(s) in the event of the demise of the investor. However, in the absence of nominee, the heirs/claimant will have to produce a number of documents like a will, legal heir certificate, no-objection certificate from other legal heirs, etc to get the units transferred in his/her name.

Is it possible to change a nominee once an investment is made?

Yes, the nominee can be changed/added/subtracted any time as per the investors wish.

Source:economictimes.indiatimes.com/articleshow

We all have our ‘eureka’ moment and mine came while buying mangoes. Yes, buying mangoes helped me explain why average costs come down more than you expect it to when investing through a SIP.

One of the key benefits of SIP is said to have cost averaging but it is not easy for investors to understand how SIP averaging is different from what you would do in your daily life why buying more of the same thing.

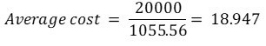

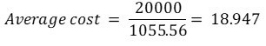

Let us say you invested ₹10,000 in a fund when the NAV was ₹20. By the next month, the NAV of the fund fell to ₹18 and you invested another ₹10,000 at this point. What would be the average cost of your units? Intuition would tell you that it would be ₹19. But look at this calculation:

What happened there? The average cost of your units is ₹18.947, and not ₹19! How is that?

Let us just keep aside the above calculation for a minute and take this completely unrelated example.

Just like I did, let us say you too went to the market to buy 2 KG of mangoes, expecting them to be selling for ₹80 for a KG. But to your utter dismay, you found the price to be ₹120 per KG. Disappointed, you decided to buy only 1 KG. But as you were walking back, you found another cart selling the same mangoes for ₹60 a KG. You were elated and bought another KG of mangoes.

What was the average cost of the mangoes?

This time it is really simple. The average cost per KG is (120 + 60) / 2 = ₹90. Just as your intuition would tell you.

So what is the difference between this and the SIP?

When you went out to buy the mangoes, you bought the same quantity of mangoes at different rates. Hence you paid a smaller sum where the rate was lower. But when you were investing in SIP, you invested the same amount, regardless of the lower NAV. This means you bought a higher number of units at the lower cost.

To take the above example once again, suppose instead of buying 1 KG for the second cart, you again bought mangoes for ₹120. You would end up with 3 KG of mangoes and your average per KG cost would have been ₹80 (and not ₹90), and you would happily walk back home, having bought the mangoes for the expected price.

This is exactly what is happening in the SIPs. You are not buying the same number of units at a lower cost when the market is falling. You are buying a higher number of units at a lower cost. Thus your average cost comes down more than you would expect it to.

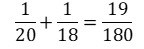

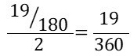

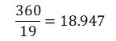

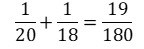

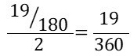

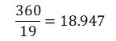

Mathematically speaking, the average cost of your units can be arrived at by taking the harmonic mean of all the NAVs at which you invested. Harmonic mean is essentially the reciprocal of the average of reciprocals of all your numbers. You can read more here: Harmonic Mean – Wikipedia.

So to calculate your average cost from the first example, you would sum the reciprocals of the NAVs, i.e.:

You would then divide it by the number of observations, i.e.:

You would then take the reciprocal of this, i.e.:

And this gives you the average cost of your units.

Harmonic mean might not be as intuitive as regular average, but it answers your questions on average rates. And the above example shows us that when you invest through SIP, cost averaging works better than you would normally expect it to. And this, therefore, is one more reason why we recommend SIPs to our investors. This article first appeared in the online edition of Financial Express.

Source: https://blog.fundsindia.com/

One of the key benefits of SIP is said to have cost averaging but it is not easy for investors to understand how SIP averaging is different from what you would do in your daily life why buying more of the same thing.

Let us say you invested ₹10,000 in a fund when the NAV was ₹20. By the next month, the NAV of the fund fell to ₹18 and you invested another ₹10,000 at this point. What would be the average cost of your units? Intuition would tell you that it would be ₹19. But look at this calculation:

What happened there? The average cost of your units is ₹18.947, and not ₹19! How is that?

Let us just keep aside the above calculation for a minute and take this completely unrelated example.

Just like I did, let us say you too went to the market to buy 2 KG of mangoes, expecting them to be selling for ₹80 for a KG. But to your utter dismay, you found the price to be ₹120 per KG. Disappointed, you decided to buy only 1 KG. But as you were walking back, you found another cart selling the same mangoes for ₹60 a KG. You were elated and bought another KG of mangoes.

What was the average cost of the mangoes?

This time it is really simple. The average cost per KG is (120 + 60) / 2 = ₹90. Just as your intuition would tell you.

So what is the difference between this and the SIP?

When you went out to buy the mangoes, you bought the same quantity of mangoes at different rates. Hence you paid a smaller sum where the rate was lower. But when you were investing in SIP, you invested the same amount, regardless of the lower NAV. This means you bought a higher number of units at the lower cost.

To take the above example once again, suppose instead of buying 1 KG for the second cart, you again bought mangoes for ₹120. You would end up with 3 KG of mangoes and your average per KG cost would have been ₹80 (and not ₹90), and you would happily walk back home, having bought the mangoes for the expected price.

This is exactly what is happening in the SIPs. You are not buying the same number of units at a lower cost when the market is falling. You are buying a higher number of units at a lower cost. Thus your average cost comes down more than you would expect it to.

Mathematically speaking, the average cost of your units can be arrived at by taking the harmonic mean of all the NAVs at which you invested. Harmonic mean is essentially the reciprocal of the average of reciprocals of all your numbers. You can read more here: Harmonic Mean – Wikipedia.

So to calculate your average cost from the first example, you would sum the reciprocals of the NAVs, i.e.:

You would then divide it by the number of observations, i.e.:

You would then take the reciprocal of this, i.e.:

And this gives you the average cost of your units.

Harmonic mean might not be as intuitive as regular average, but it answers your questions on average rates. And the above example shows us that when you invest through SIP, cost averaging works better than you would normally expect it to. And this, therefore, is one more reason why we recommend SIPs to our investors. This article first appeared in the online edition of Financial Express.

Source: https://blog.fundsindia.com/

Mutual Fund Schemes Categorization – What Investors should know?

Last year, SEBI has issued new reforms on the categorization of Mutual Fund Schemes and restricted such categorization to only 5. These SEBI reforms would be shaking up Mutual Fund Industry who are floating various mutual fund schemes in the same category with small changes. Currently, the mutual fund industry is Rs 20 Lakh Crores where more than 830 Schemes are running and out of which 317 are open-ended schemes which would impact. What are these new reforms/guidelines from SEBI about mutual fund schemes? What happens to existing Mutual Fund Schemes in the same category. What should investors know about New Mutual Fund Schemes Categorization? What are the 5 Baskets where SEBI is asking AMCs to classify the mutual fund schemes?

What are SEBI New Reforms on Mutual Fund Schemes?

1) SEBI issued new norms/guidelines on mutual fund schemes and all such schemes should be categorized into 5 baskets only.

2) 5 Baskets are Equity, Debt, hybrid, solution-oriented and other mutual fund schemes.

3) Mutual Fund Houses cannot launch similar schemes in the same theme. Means, there would not be any duplicate plans which AMC can launch or run.

4) Sebi has said the one-scheme-per-category rule will not be applicable to exchange-traded funds (ETFs) tracking different indices; fund-of-funds having different underlying schemes; sectoral and thematic funds investing in different sectors.

5) Mutual Fund Houses (AMC) have to submit the proposal of their existing schemes along with categorization of the schemes within next 2 months and should implement new reforms in the next 3 months without fail.

6) SEBI provided guidelines about the classification of large-cap, mid-cap and small schemes. First 100 companies in market capitalization are termed as large-cap, First 101 to 250 companies are termed as mid-cap companies and after 250+ market capitalization are termed as smallcap companies. Association of Mutual Funds of India (AMFI) would update this data twice on their website which would be a basis where mutual fund schemes can invest based on their investment objectives. This would apply to all existing open-ended mutual fund schemes which got SEBI clearance, however yet to be launched and for all schemes where draft documents submitted which are pending with SEBI for approval.

Why SEBI feels new reforms required for mutual fund categorization?

SEBI feels that there are different schemes being launched by the same MF house with small variations. Such categorization would clearly distinct in asset allocation and investment strategy. This would also bring uniformity among mutual fund schemes being launched by different mutual fund AMCs.

What are the 5 Baskets where Mutual Fund Scheme are Categorized now?

As per SEBI new reforms, mutual fund schemes have to be classified into 5 baskets. However, SEBI was liberal in providing further sub-classification in equity, debt and hybrid segment. Currently, mutual fund industry is Rs 20 Lakh Crores where more than 830 Schemes and out of which 317 are open-ended schemes which would impact. Here is how the new basket of mutual fund schemes looks like:

Basket#1 – Equity Mutual Fund Schemes

This equity mutual fund schemes would comprise of the following schemes.

1) Multi-cap Fund

2) Large-cap Fund

3) Large and mid-cap fund

4) Mid-cap fund

5) Small-cap fund

6) Dividend Yield Fund

7) Value Fund & Contra Fund

8) Focused Fund

9) Sectoral/Thematic Fund

10) Equity Linked Mutual Fund Schemes

Basket#2 – Debt Mutual Fund Schemes

This debt mutual fund schemes would comprise of the following schemes.

1) Overnight Fund – Investment in overnight securities having maturity of 1 day.

2) Liquid Mutual Funds

3) Ultra Short Term Funds

4) Low Duration Funds

5) Money Market Funds

6) Short Duration Funds

7) Medium Duration Funds

8) Medium to long duration funds

9) Long Duration Fund

10) Dynamic Fund

11) Corporate Bond Fund

12) Credit Risk Fund

13) Banking and PSU Fund

14) Gilt Fund

15) Gilt Fund with 10 year constant duration

16) Floater Fund

Basket#3 – Hybrid Schemes

This hybrid mutual fund schemes would comprise of the following schemes.

1) Conservative Hybrid Funds

2) Balanced Hybrid Fund & Aggressive Hybrid Funds

3) Dynamic Asset Allocation or Balanced Advantage Funds

4) Multi Asset Allocation Fund

5) Arbitrage Fund

6) Equity Savings

Basket#4 – Solution Oriented Schemes

This solution-oriented mutual fund schemes would comprise of the following schemes.

1) Retirement Fund – Scheme having a lock-in for at least 5 years or till retirement age whichever is earlier.

2) Children’s Fund – Scheme having a lock-in for at least 5 years or until the child attains the age of majority whichever is earlier.

Basket#5 – Other Schemes

Other mutual fund schemes would comprise of the following schemes.

1) Index Funds / ETFs

2) Funds of Funds (Overseas / Domestic)

What does Mutual Fund AMC’s need to do now?

As per SEBI new guidelines about the categorization of mutual fund schemes, AMCs need to come back to SEBI with the proposal about merger or wind-up (if the merger is not possible) of schemes into these 5 baskets. Mutual Fund AMC is now allowed only one scheme in the provided basket and sub-basket classification. They need to classify all their equity mutual fund Schemes into sub-basket of 10 schemes. They need to reclassify all their debt funds into 16 categories. For hybrid funds, they need to classify them into 6 and solution-oriented into 2 sub-classifications.

How does this impact Mutual Fund Investors?

You might be investing in several mutual fund schemes. However, once the rationalization/merging of mutual fund schemes happens, this would have some impact on your portfolio. If you are investing in 10 schemes, they might become 8. If you are investing in specific AMC schemes, in specific market capitalization, your scheme count can come down drastically. E.g. HDFC Top 200 and HDFC Equity Fund as an example would get reviewed and they can get merged. The second example could be Birla SL Frontline Equity, Birla SL Top 100 Fund and Birla SL Equity Fund may get reviewed and may get merged into 1-2 funds. These are just examples to make you understand and this does not mean they would really get merged. Investors need to wait and watch about the proposal of Mutual Fund AMCs to SEBI and once implemented, based on it you can review your mutual fund portfolio. However one needs to keep an eye about the developments.

Source: https://myinvestmentideas.com/

Last year, SEBI has issued new reforms on the categorization of Mutual Fund Schemes and restricted such categorization to only 5. These SEBI reforms would be shaking up Mutual Fund Industry who are floating various mutual fund schemes in the same category with small changes. Currently, the mutual fund industry is Rs 20 Lakh Crores where more than 830 Schemes are running and out of which 317 are open-ended schemes which would impact. What are these new reforms/guidelines from SEBI about mutual fund schemes? What happens to existing Mutual Fund Schemes in the same category. What should investors know about New Mutual Fund Schemes Categorization? What are the 5 Baskets where SEBI is asking AMCs to classify the mutual fund schemes?

What are SEBI New Reforms on Mutual Fund Schemes?

1) SEBI issued new norms/guidelines on mutual fund schemes and all such schemes should be categorized into 5 baskets only.

2) 5 Baskets are Equity, Debt, hybrid, solution-oriented and other mutual fund schemes.

3) Mutual Fund Houses cannot launch similar schemes in the same theme. Means, there would not be any duplicate plans which AMC can launch or run.

4) Sebi has said the one-scheme-per-category rule will not be applicable to exchange-traded funds (ETFs) tracking different indices; fund-of-funds having different underlying schemes; sectoral and thematic funds investing in different sectors.

5) Mutual Fund Houses (AMC) have to submit the proposal of their existing schemes along with categorization of the schemes within next 2 months and should implement new reforms in the next 3 months without fail.

6) SEBI provided guidelines about the classification of large-cap, mid-cap and small schemes. First 100 companies in market capitalization are termed as large-cap, First 101 to 250 companies are termed as mid-cap companies and after 250+ market capitalization are termed as smallcap companies. Association of Mutual Funds of India (AMFI) would update this data twice on their website which would be a basis where mutual fund schemes can invest based on their investment objectives. This would apply to all existing open-ended mutual fund schemes which got SEBI clearance, however yet to be launched and for all schemes where draft documents submitted which are pending with SEBI for approval.

Why SEBI feels new reforms required for mutual fund categorization?

SEBI feels that there are different schemes being launched by the same MF house with small variations. Such categorization would clearly distinct in asset allocation and investment strategy. This would also bring uniformity among mutual fund schemes being launched by different mutual fund AMCs.

What are the 5 Baskets where Mutual Fund Scheme are Categorized now?

As per SEBI new reforms, mutual fund schemes have to be classified into 5 baskets. However, SEBI was liberal in providing further sub-classification in equity, debt and hybrid segment. Currently, mutual fund industry is Rs 20 Lakh Crores where more than 830 Schemes and out of which 317 are open-ended schemes which would impact. Here is how the new basket of mutual fund schemes looks like:

Basket#1 – Equity Mutual Fund Schemes

This equity mutual fund schemes would comprise of the following schemes.

1) Multi-cap Fund

2) Large-cap Fund

3) Large and mid-cap fund

4) Mid-cap fund

5) Small-cap fund

6) Dividend Yield Fund

7) Value Fund & Contra Fund

8) Focused Fund

9) Sectoral/Thematic Fund

10) Equity Linked Mutual Fund Schemes

Basket#2 – Debt Mutual Fund Schemes

This debt mutual fund schemes would comprise of the following schemes.

1) Overnight Fund – Investment in overnight securities having maturity of 1 day.

2) Liquid Mutual Funds

3) Ultra Short Term Funds

4) Low Duration Funds

5) Money Market Funds

6) Short Duration Funds

7) Medium Duration Funds

8) Medium to long duration funds

9) Long Duration Fund

10) Dynamic Fund

11) Corporate Bond Fund

12) Credit Risk Fund

13) Banking and PSU Fund

14) Gilt Fund

15) Gilt Fund with 10 year constant duration

16) Floater Fund

Basket#3 – Hybrid Schemes

This hybrid mutual fund schemes would comprise of the following schemes.

1) Conservative Hybrid Funds

2) Balanced Hybrid Fund & Aggressive Hybrid Funds

3) Dynamic Asset Allocation or Balanced Advantage Funds

4) Multi Asset Allocation Fund

5) Arbitrage Fund

6) Equity Savings

Basket#4 – Solution Oriented Schemes

This solution-oriented mutual fund schemes would comprise of the following schemes.

1) Retirement Fund – Scheme having a lock-in for at least 5 years or till retirement age whichever is earlier.

2) Children’s Fund – Scheme having a lock-in for at least 5 years or until the child attains the age of majority whichever is earlier.

Basket#5 – Other Schemes

Other mutual fund schemes would comprise of the following schemes.

1) Index Funds / ETFs

2) Funds of Funds (Overseas / Domestic)

What does Mutual Fund AMC’s need to do now?

As per SEBI new guidelines about the categorization of mutual fund schemes, AMCs need to come back to SEBI with the proposal about merger or wind-up (if the merger is not possible) of schemes into these 5 baskets. Mutual Fund AMC is now allowed only one scheme in the provided basket and sub-basket classification. They need to classify all their equity mutual fund Schemes into sub-basket of 10 schemes. They need to reclassify all their debt funds into 16 categories. For hybrid funds, they need to classify them into 6 and solution-oriented into 2 sub-classifications.

How does this impact Mutual Fund Investors?

You might be investing in several mutual fund schemes. However, once the rationalization/merging of mutual fund schemes happens, this would have some impact on your portfolio. If you are investing in 10 schemes, they might become 8. If you are investing in specific AMC schemes, in specific market capitalization, your scheme count can come down drastically. E.g. HDFC Top 200 and HDFC Equity Fund as an example would get reviewed and they can get merged. The second example could be Birla SL Frontline Equity, Birla SL Top 100 Fund and Birla SL Equity Fund may get reviewed and may get merged into 1-2 funds. These are just examples to make you understand and this does not mean they would really get merged. Investors need to wait and watch about the proposal of Mutual Fund AMCs to SEBI and once implemented, based on it you can review your mutual fund portfolio. However one needs to keep an eye about the developments.

Source: https://myinvestmentideas.com/

Please do not reply back to this mail. This is sent from an unattended mail box.

Please mark all your queries / responses to webmaster@grfinancialadvisors.co.in.

Information provided on this newsletter has been independently obtained from sources believed to be reliable. However, such information may include inaccuracies, errors or omissions. grinvestmentservices.co.in and its affiliates, information providers or content providers, shall have no liability to you or third parties for the accuracy, completeness, timeliness or correct sequencing of information available on this newsletter, or for any decision made or action taken by you in reliance upon such information, or for the delay or interruption of such information. grinvestmentservices.co.in, its affiliates, information providers and content providers shall have no liability for investment decisions or other actions taken or made by you based on the information provided on this newsletter.